GST Udyog - Rate + Act & Rules

Content updated with GST Act as passed by both houses of Parliament and GST rules and GST Rates with HSN & SAC codes as approved by the GST Council through the GST Rate finder feature, formerly known as GST Connect app.

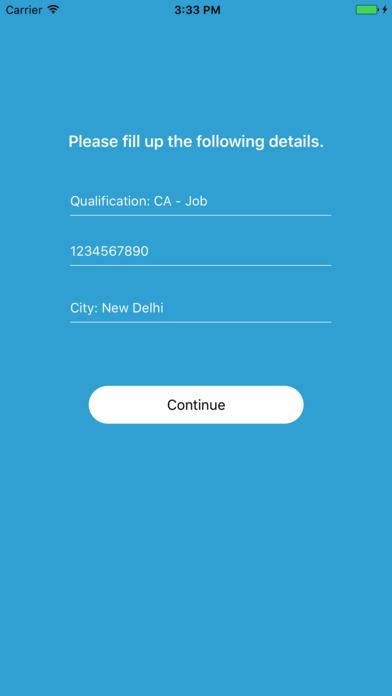

The GST India Application or GST mobile app portal contains the following features:

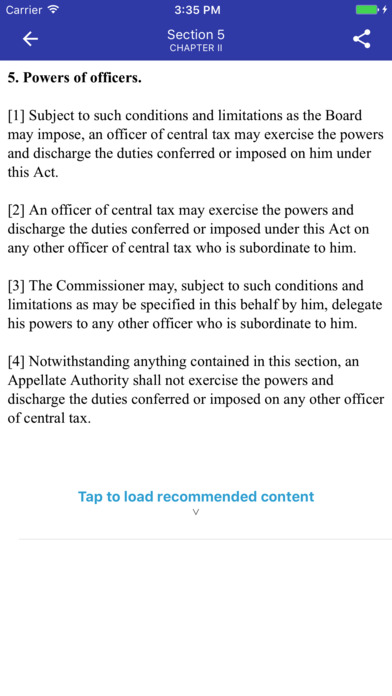

Offline GST Act App- Offline access to GST India Acts or GST Bill/GST law (CGST, IGST)

GST Articles- Exclusive Articles by top experts from all over India on GST India provisions.

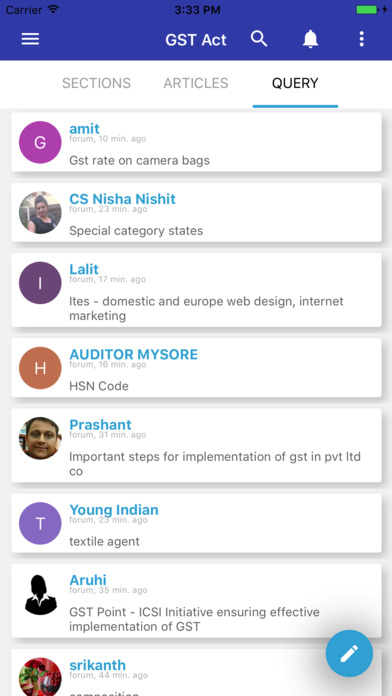

GST Query- One stop destination to get all your GST queries answered.

GST News- Latest news/updates on GST Tax Act and official changes as introduced by CBEC in India.

GST Rules- Account s and Record Rules, Advance Ruling, Anti profiteering rules,

Appeals and Revisions, Assessment and Audit Rules, Composition Rules, E way Rules,

Invoice Debit and Credit Notes Rules, Input tax Credit Rules, Payment Rules, Refund

Rules, Registration Rules, Return Rules, Transition Rules and Valuation Rules

We have also incorporated rates- GST Rates of Goods and GST rate list of services for all items. This is an exhaustive list for the rates. Such rates have been decided by the GST Council as incorporated in the GST Rate finder feature. The app was formerly known as GST connect app.

GST rates, GST notifications and HSN Code search have been made available in the latest version of the GST App. The HSN Code search feature works in offline mode as well and the GST Notifications and Circulars are updated by us in real time.

The Goods and Services Tax Bill or GST Bill proposes a one-tax-regime for Indirect tax in India. GSTN has shortlisted various companies to act as GST Suvidha providers like tally solutions, karvy data management services, taxmann publication. Out of the big 4 consisting of Deloitte, Ernst and Young , PWC and Deloitte- Deloitte and E&Y have been shortlisted as GST suvidha providers to ease the transition process to the new tax regime. We will soon be incorporating features for GST enrolment/enrollment or registration, GST calculator- the calculator would include the different rates for various items, GST refund help, GST tally or accounting integration and GST faq in hindi. Other features like login access, GST game, helpline number, support for languages like hindi, gujarati, bengali, marathi, punjabi, tamil, telgu will be incorporated to act as a complete GST guide/club and connect for users all over India. This GST India Act or Taxes App acts a one stop GST helpline or software for all users . It is one of the top tax app in India incorporating gst model law or bill as made available by CBEC. The GST calculator will make it the only app to include all resources required by a GST professional and to act as the one stop helpline for all things GST. The application for ca, cs, cma, mba and other professionals contains the following Chapters : Accounts And Records, Advance Ruling, Appeals and Revision, Assessment, Audit, Demands and Recovery, Electronic Commerce, Input Tax Credit, Inspection, Search, Seizure And Arrest, Job Work, Levy Of and Exemption From Tax, Liability To Pay In Certain Cases, Miscellaneous Provisions, Offences And Penalties, Payment Of Tax, Preliminary, Presumption As To Documents, Prosecution And Compounding Of Offences, Refunds, Registration, Repeal And Saving, Returns, SCHEDULE, Tax Invoice, Credit And Debit Notes,Time And Value Of Supply, Transfer Of Input Tax Credit, Transitional Provisions